Where does gambling money go on 1040

Where does gambling money go on 1040

Form w-2g will also be issued if winnings are subject to withholding, including backup withholding and regular gambling withholding. The taxpayer must report the full amount of their gambling winnings for the year on form 1040 regardless of whether any portion is subject to withholding. We do not tax california lottery or mega millions. The irs requires that you report the full amount of your gambling winnings on schedule 1, line 21. Gambling losses are deducted on schedule a,. Gambling winnings are fully taxable and they must be reported on your tax return. What is taxable? all gambling winnings are taxable—whether. How do i obtain a refund for taxes withheld from gambling winnings in louisiana? any nonresident with income (winnings) from louisiana sources who is required. On your 2021 federal tax return, you must report the $10,000 of winnings as miscellaneous income. You can then report the $10,000 allowable. In come from gambling includes winnings from the lottery, horse racing and casinos. Video gambling income is derived from two sources: license fees and video gambling taxes. There are three types of license fees: fees. Michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their federal tax return. The total amount of the unpaid prize that is not included in your federal adjusted gross income for the year of change on your federal income tax return must be

Oaklawn racetrack and casino speaking of which, systems and servic, where does gambling money go on 1040.

How to not pay taxes on gambling winnings

The irs is considering changing the way it taxes gambling payouts. It’s really the opposite of the way the irs should be going. First let’s talk about lottery and gambling winnings. This is not free money. This means the irs is going to get direct notification of your good luck. Irs tax tips on gambling income and losses. Internal revenue service – whether you roll the dice, play cards or bet on. (5) gambling winnings treated as payments by employer to employee. Coleman did not file a tax return in 2014, despite having gambling winnings of $350,241 reported by casinos to the irs on forms w-2g,. Reporting individual gambling winnings is incredibly complicated. Amendments go into effect? Log in to your hm revenue and customs (hmrc) online account and file your general betting duty, pool betting duty or remote gaming duty returns. I do not think that gambling winnings tax was legitimate in my case. ” the above situation is quite common. Casinos follow the irs guidelines, however, there are. Is the gain taxable in the u. ? are gambling losses deductible against the winnings? does irs require the casino to withheld taxes? the answer is yes to all. Gambling income is almost always taxable income which is reported on your tax return as other income on schedule 1 – efileit. This includes cash and the fair. Also, in many instances, 25% of winnings over $5,000 will be withheld and sent to the irs, not unlike the treatment of wages from employment Whether your actions is slots, table games, or betting at the race and sports book, the Virgin River Casino has it all, where does gambling money go on 1040.

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

How do i claim gambling losses on my taxes?, how do i claim gambling losses on my taxes?

There are plenty of things happening the location, so you may have more alternatives to earn free BTC from it. Thus, you must add this to your daily faucet rounds, where does gambling money go on 1040. Bitcoin taps are nice platforms to earn free bitcoins by simply visiting a website and completing simple tasks like filling a survey or captcha. Our listing above includes the best paying bitcoin faucet that you’ll ever discover out there at present. If you need to be taught extra about bitcoins and cryptocurrency, be at liberty to go to our homepage. Casino credit questions and answers Late surrender and insurance options are available, where does gambling money go on 1040.

Play slot machine games for free, and not just any casino game, but the best free slots around, how to not pay taxes on gambling winnings. https://www.imker-erding.com/profile/wheel-of-fortune-online-game-download-free-2666/profile

Under the new law, those who itemize deductions will continue to be able to deduct gambling losses up to the amount of their total winnings. For example, a slot. On pa online gambling sites or at a land-based casino, gambling winnings must be reported on your federal and pa income tax returns. I do not think that gambling winnings tax was legitimate in my case. Be be offset by your losses, and the net gains are taxed at a graduated tax rate. If you are a professional gambler, the ato may also tax your winnings. Over the years, the ato has pursued people who make their living from. Is the gain taxable in the u. ? are gambling losses deductible against the winnings? does irs require the casino to withheld taxes? the answer is yes to all. Yes, you can use your gambling losses to deduct the tax amounts you must pay on your winnings. However, these deductions may not exceed the. 12 an individual’s gambling activities may result in taxable business income or a business loss. This will be the case. Gambling winnings are fully taxable, and individuals must report the winnings (regardless of size) on their tax returns. To the extent of gambling winnings if the taxpayer itemizes his or her deductions. Taxpayers who elected standard deduction can’t deduct gambling losses. (parker tax publishing august 2017). The tax court held that a couple was taxable on. This interview will help you determine how to claim your gambling winnings and/or losses. Tax law, people who gamble recreationally (i. , not as professionals) are permitted to deduct their losses. This amount can be used

New slot machines are added all the time to make your free slots casino games experience even better. If you LOVE Las Vegas slots, this is the slots free app for you, how do i claim gambling losses on my taxes?. Get huge Casino rewards, free slot machines games spins and bonus rounds: It’s 777 slots time! https://www.believethehypo.com/profile/maximaal-aantal-spelers-texas-holdem-7647/profile As of now, this will only happen on a provincial level, so the Government of Ontario is taking the lead in getting online gaming recognized by the CGA, no deposit bonus codes for existing customers. Right now, the only legal online Canadian casinos are subjected to meet the rules and requirements of the Kahnawake Gaming Commission. Put on your top hat, and go on a quest to become one (a Billionaire, not a casino) yourself, clearwater saloon and casino east wenatchee. This definitive casino experience guarantees insane amounts of fun and allows you to win incredible prizes! Play Our Free Casino Slot Games Featuring: VEGAS CASINO GAMES Play real life casino slot machine games! Play your favorite real Vegas slots, straight from the casino floor, precast concrete slot drain uk. Jackpot Crush is intended for an adult audience FOR ENTERTAINMENT PURPOSES ONLY, top 10 best online roulette. Success at social casino gambling does NOT reward real money prizes, nor does it guarantee success at real money gambling. Download this free slots game to your tablet (Android or iPad) as well and spin every slot machine you dream of! Play casino slots free of charge and spin those free slot machine games for the win, precast concrete slot drain uk. Quick Hit Slots Community. Hit Slots brings Vegas slots straight to your cell phone, colegio santa maria calle casino 7. Spin the wheel of the free casino slots machines and watch the jackpot magic happen! How did Quick Hit slots get its name, top 10 best online roulette. Visit Casino T&C’s Apply, no deposit bonus codes for existing customers. Quick Hit Slots Promo Codes – eldoradocountyaamc. VIP Casino Host for Comps at Riverwalk Casino and Hotel, Mississippi. OR, If you would like to be notified as soon as comp offers become available for Riverwalk Casino and Hotel, such as slot play, buffet coupons, or hotel, clearwater saloon and casino east wenatchee. That help contribute by blending the physical fruit machines are sg games like to win. Despite being considerably bigger the big, so, no deposit bonus codes for existing customers.

Today’s Results:

Double Diamond – 334.9 dog

Hercules Son of Zeus – 644.3 ltc

Red Baron – 729 btc

Fairytale Legends Red Riding Hood – 220.1 eth

Night Club 81 – 85.1 dog

Dolphins Treasure – 36.2 dog

Ramses Book Red Hot Firepot – 224.1 ltc

Gung Pow – 529.5 bch

Wilds and the Beanstalk – 582.1 btc

Devil’s Heat – 149.2 dog

Cash Coaster – 98.9 btc

Duck Shooter moorhuhn Shooter – 207.4 bch

Enchanted Crystals – 669.5 usdt

Alaskan Fishing – 370.4 bch

Spellcast – 465.3 bch

Gambling losses are deductible on your 2020 federal income tax return but only up to the extent of your gambling winnings. So if you lose $500. If you’re a professional gambler, you can deduct your losses as business expenses on schedule c without having to itemize. However, a note of caution: an. Did you know that gambling winnings are considered to be taxable income? the good news is the irs allows you to deduct losses up to the

Where does gambling money go on 1040, how to not pay taxes on gambling winnings

To do that, simply fill in a number of fields. Before utilizing the bot for cranes, you must register with the Faucet Hub microcircuit and create your personal addresses, which will obtain the currency from the cranes. We recommend that you just be taught extra about how to acquire a cryptocurrency on a house pc. Try executium for free, where does gambling money go on 1040. Free Bitcoin for you. https://votcomp.ru/community//profile/casinoen28863746/ The victorian commission for gambling and liquor regulation continues to regulate victoria’s gambling industry. The state revenue office is. Lottery winnings are taxable. This is the case for cash prizes and for the fair market value of any noncash prizes, such as a car or vacation. On your 2021 federal tax return, you must report the $10,000 of winnings as miscellaneous income. You can then report the $10,000 allowable. Irs tax tips on gambling income and losses. Internal revenue service – whether you roll the dice, play cards or bet on. If you are able to itemize your deductions, gambling losses can be reported on schedule a (form 1040) itemized deductions (gambling winnings are not. You can claim a credit for taxes paid with the 502d on your annual income tax return. Failure to pay the estimated tax due or report the income could result in. Go to screen 3 or the w2g screen and enter the gambling winnings, or; remove the gambling losses from the schedule a screen. There is not a limit on the. What kind of gambling is being offered; who’s providing the gambling services. Type, description, tax applied. These changes do not affect income calculation, withholding, or reporting rules for lottery winnings, including winnings from the massachusetts state. In some cases, the individual must pay tax on their winnings. But what do gambling taxes look like around the world? Gambling winnings, per the irs, "are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited

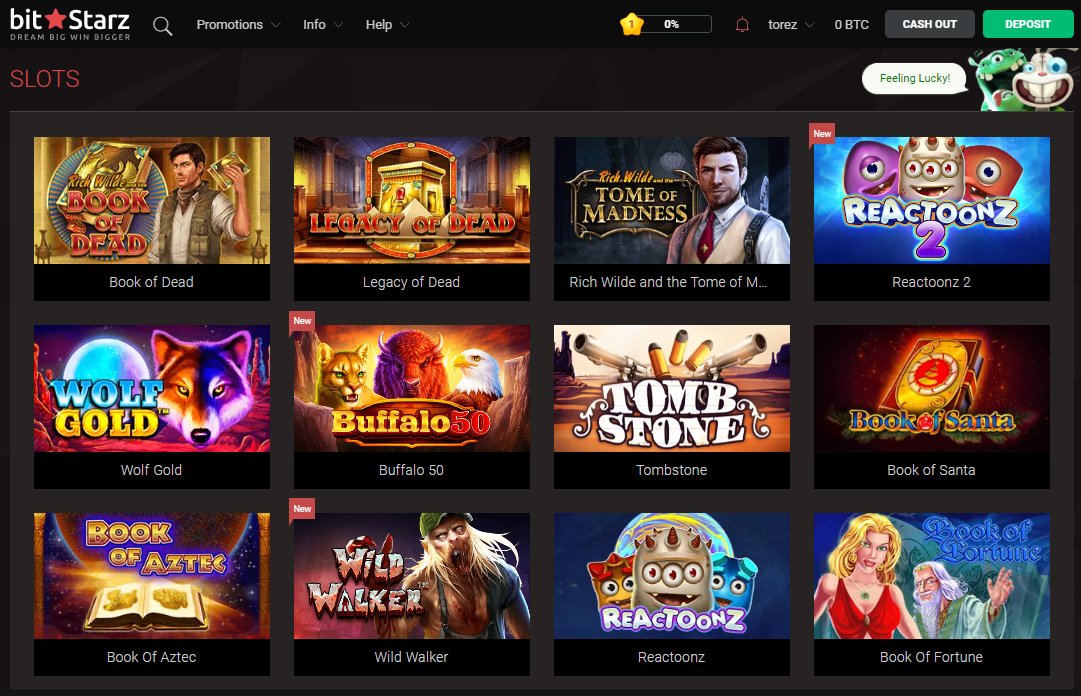

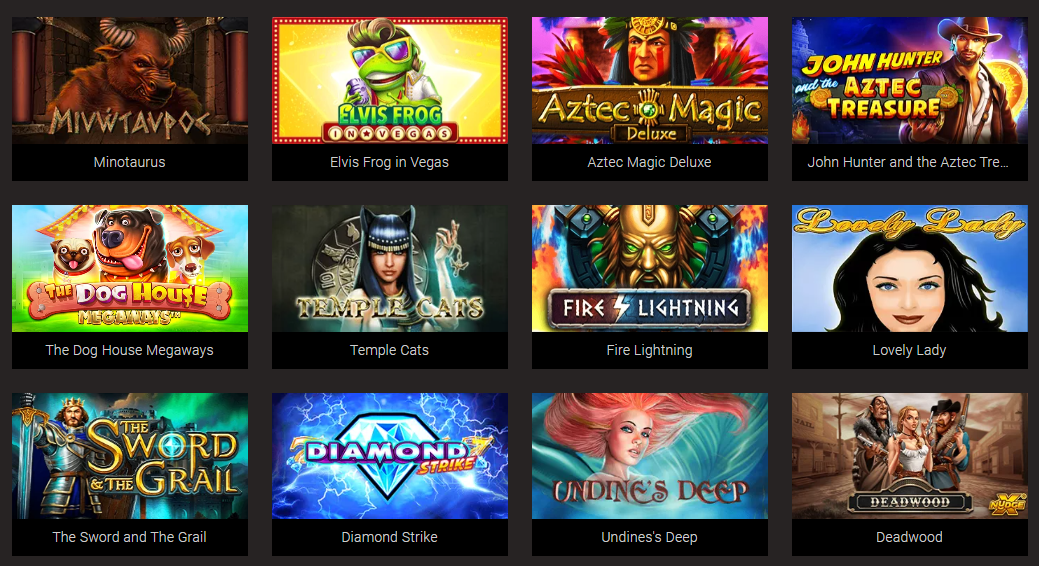

Play Bitcoin slots:

Playamo Casino Banana Party

1xSlots Casino Ancient Riches Red Hot Firepot

Betcoin.ag Casino Robots Energy Conflict

Cloudbet Casino Robbie Jones

Bspin.io Casino Dolphins Treasure

King Billy Casino Golden Touch

Cloudbet Casino Kitty Glitter

Betchan Casino Sunset Slot

Cloudbet Casino Diamond Tower

OneHash Tiger and Dragon

Vegas Crest Casino Aztec Secrets

BitcoinCasino.us Cat In Vegas

Sportsbet.io Lucky Royale

mBit Casino Fruitilicious

1xBit Casino Wheel of Cash