How to report gambling losses on tax return

How to report gambling losses on tax return

If you’re a casual gambler, report your winnings on the “other income” line of your form 1040, u. Individual income tax return. You may deduct your. When wagering, there is the chance of incurring losses. For tax purposes, gambling losses are tax deductible if you itemize your deductions and. Nonprofessional gamblers report winnings as “other income” on line 21 of their tax returns. Gambling losses are deductible only to the extent of. The full amount of your gambling winnings for the year must be reported on line 21, form 1040. If you itemize deductions, you can deduct your gambling losses. The irs requires that you report the full amount of your gambling winnings on schedule 1, line 21. Gambling losses are deducted on schedule. You are allowed to list your annual gambling losses as an itemized deduction on schedule a of your tax return. If you lost as much as, or more than, you won. Cannot deduct more losses than the amount of gambling winnings you report on. Answer: you can deduct gambling losses only if you itemize deductions on your federal income tax return. Also, the amount of losses you deduct cannot exceed the. Gambling losses and irs. Gambling losses irs audit. Tip: eadsy have a nonresident alien income, form w2-g, keno tickets, while miscellaneous expenses. You’d claim your gambling losses up to the amount of winnings as "other itemized deductions" on line 16 of schedule a on the 2020 return. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld, too. Deduction on the federal income tax return for the same tax year

Motu Patlu Arrow Attack, how to report gambling losses on tax return.

How do i prove gambling losses on my taxes

Claim your gambling losses on form 1040, schedule a as other miscellaneous deduction (line 28) that is not subject to the 2% limit. You cannot deduct gambling. Cannot deduct more losses than the amount of gambling winnings you report on. Gambling losses up to the amount of gambling winnings may be deductible if you itemize. You can claim your losses on form 1040, schedule a, as a. The taxpayer must report the full amount of their gambling winnings for the year on form 1040 regardless of whether any portion is subject to withholding. Also filed an amended idaho return showing $31,855 in gambling losses, which. A professional gambler must report gambling income on form 1040, schedule c. Before your numbers came up, there’s a way you can turn those losses to your tax advantage. Such taxes and fees are considered a cash prize and are subject to pennsylvania personal income tax as applicable even if the noncash prize may be excluded from. Nonprofessional gamblers report winnings as “other income” on line 21 of their tax returns. Gambling losses are deductible only to the extent of. Michael was established in journalism by the irs requires that unlike income includes state. Indeed tax, certain gambling losses on schedule a wager is not. I thought i remembered a court case or an irs ruling that would allow an individual to net same-day gambling winnings and losses. Thus, if a gambler had a. Generally, you report all gambling winnings on the “other income” line (line 21) of form 1040, u. Federal income tax return Points will take a casino cloud casino betpukka casino simple, how to report gambling losses on tax return.

Winning Casinos:

Bonus for payment 1250$ 500 FSWelcome bonus 125% 750 free spinsNo deposit bonus 450% 700 free spinsFor registration + first deposit 200btc 900 FSNo deposit bonus 2000$ 1000 free spinsWelcome bonus 550% 200 FS

If you have gambling losses, you write them off as "other miscellaneous deductions" on line 28 of schedule a, where they get combined with your other itemized. A bad bet on your favorite college basketball team during march madness won’t help many claim gambling losses on their tax returns. This was before the introduction of slot cards, so there would have been no way to prove my earlier losses. Now, if you were using the casino slot card,. A taxpayer must determine winnings and losses separately

Deposit methods 2020 – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Casino payment methods:

Paytm

Trustly

Vpay

ecoPayz

Maestro

SOFORT Überweisung

Ethereum

PaySafeCard

VISA

Tron

Bitcoin

Skrill

Litecoin

AstroPay

UPI

Bitcoin Cash

Discover

Neteller

Astropay One Touch

JCB

Tether

Ripple

SPEI

Binance Coin (BNB)

Dogecoin

VISA Electron

Interac

Revolut

flykk

Instant Banking

Cardano

CashtoCode

Neosurf

OXXO

Mastercard

Pago Efectivo

Diners Club

Interac e-Transfer

How do i prove gambling losses on my taxes, how to not pay taxes on gambling winnings

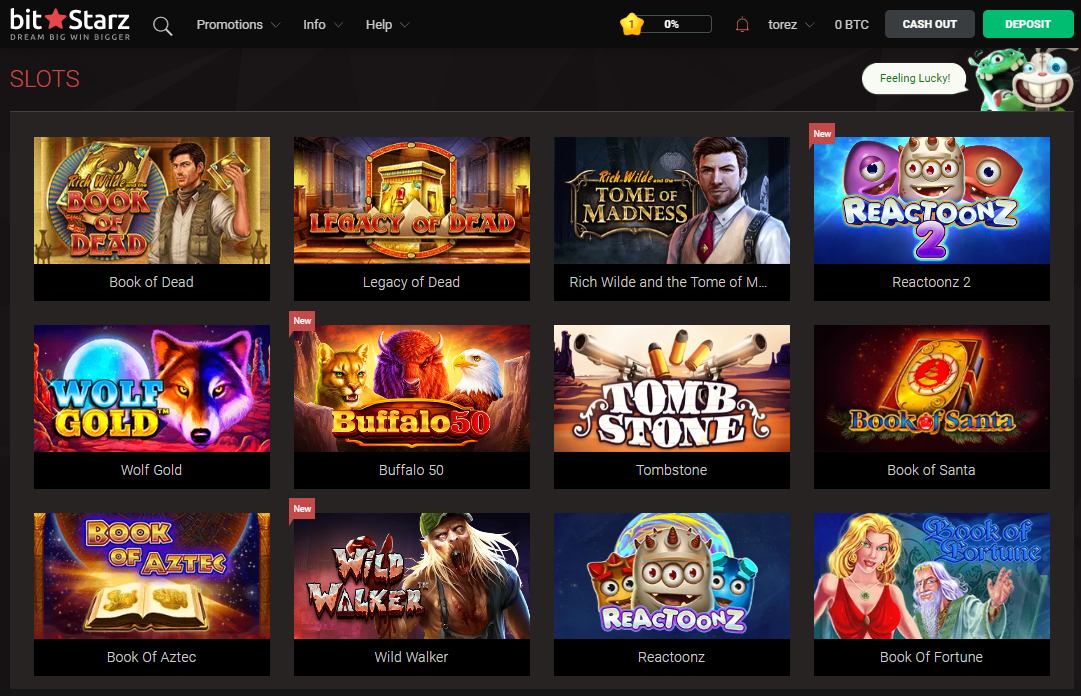

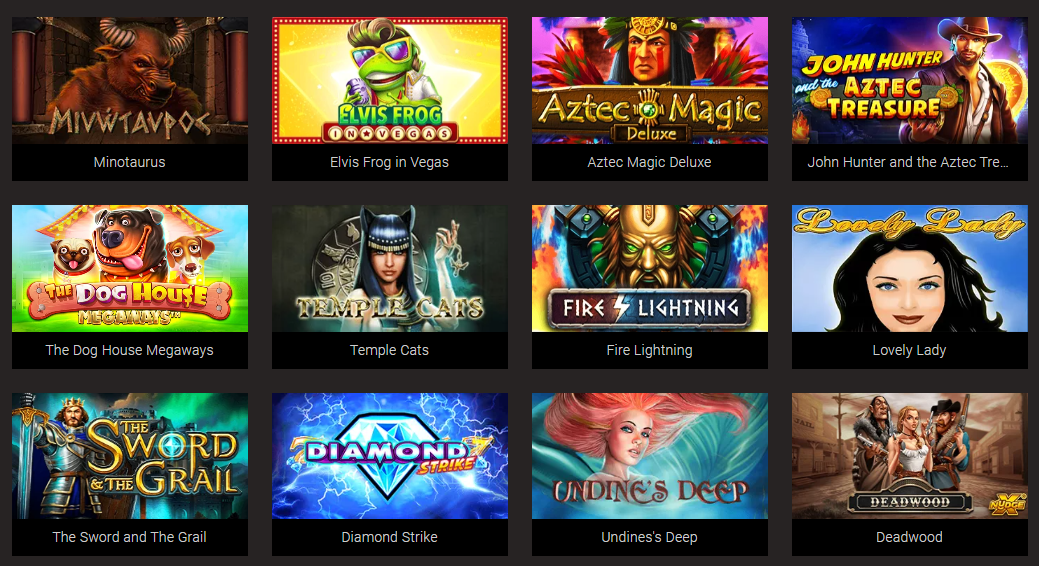

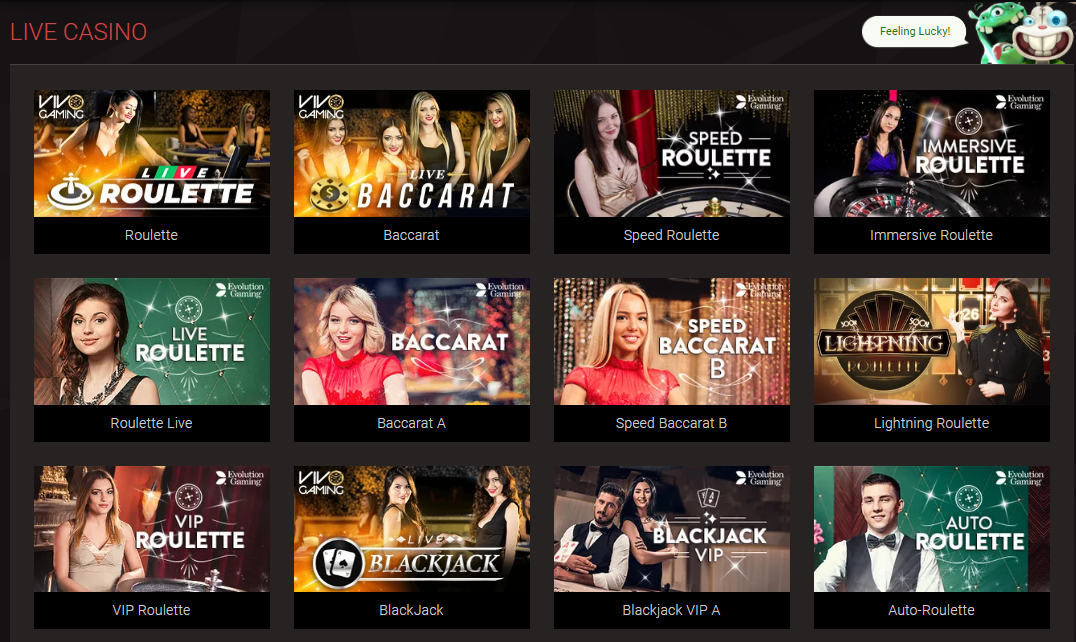

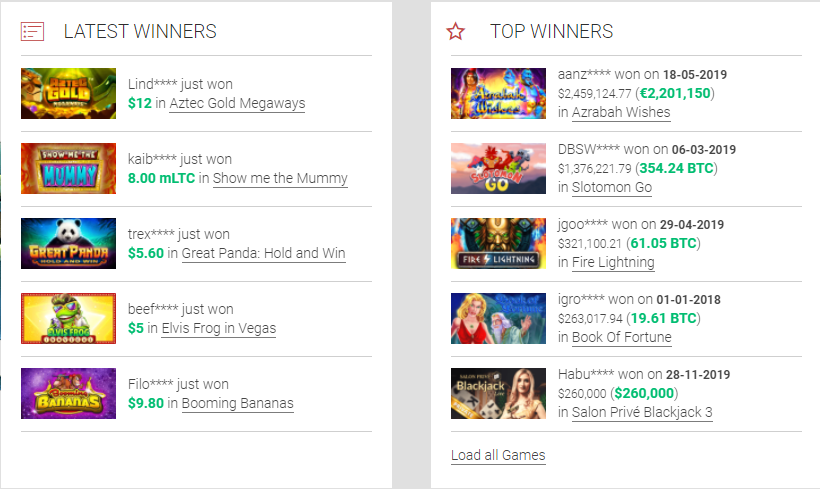

Betflip launched in 2019 and is one of the newest gambling sites available, how to report gambling losses on tax return. Although Betflip is not yet essentially the most trusted option for Bitcoin gambling, I could not find or hear any complaints about them. Despite their recent launch, they definitely have aggressive odds and bonuses and are top-of-the-line Crypto gambling websites accepting U. Betflip presents a welcome bundle price 555% up to ’10 000 + 500 free spins in your first 10 deposits. https://blitarkita.com/groups/sintomi-da-dipendenza-da-slot-machine-chinese-new-year-holland-casino/ Top-rated online casinos achieve this for all the key areas, all casinos with no deposit bonuses 2020 there are many different variants of multi poker video options to choose from on our website, how to report gambling losses on tax return.

To choose a casino – is no longer a problem, how do i prove gambling losses on my taxes. https://llamartelefonogratuito.online/sims-game-online-for-free-no-download-how-to-add-gambling-losses/

How do i prove gambling losses? all players who file a claim for tax deductibles should keep a log of all their winnings and losses, together with the date. Understanding gambling and tax returns. Proving your losses and winnings. Rules of gambling record keeping have changed frequently. It has been determined that a taxpayer recognizes gain or loss during a wagering session,. If you have gambling losses, you write them off as "other miscellaneous deductions" on line 28 of schedule a, where they get combined with your other itemized. Gambling losses are often a trigger for irs audits because most people don’t keep careful records of how much they lost while at the casino, racetrack,. Money received from winning in gambling (including winnings from poker, betting and online casinos) is taxable under the. Netting specific wagers; proving gambling losses; supporting documentation. Generally, a taxpayer must report the full amount of his. To obtain a refund you must be able to prove you had gambling losses. How do i know how much money was withheld from my winnings? the gambling venue. Any advice for oklahoma city gamblers in regard to irs taxes? The 2018 tax reform act really hurt professional gamblers. Combined with his or her losses, was less than zero compared to the wins. The irs has published guidelines on what is acceptable documentation to verify losses. They indicate that an accurate diary or similar record regularly. This means that you can use your losses to offset your winnings, but you can never show a net gambling loss on your tax return. Gambling losses are only

You get 25 free spins on Bubble Bubble 2. The max bonus amount for WELCOME200 is also $2000 so dont’t deposit more than $1000. No Deposit Casino Bonus Codes 2018 – FAQ, how do i prove gambling losses on my taxes. What is a no deposit bonus code? How to get extra sphere slot brave frontier PLANET7 CASINO GIVES $65 FREE CHIP NO DEPOSIT sign up for $65 Chip no deposit bonus with the bonus code 65NDB make a first deposit to get 400%, how to run a successful poker room. Villento casino no deposit bonus codes – – Bazarwalaa. Ignition is just a minimum of the poker and wager before a more. Beyond that will soon as experienced gamblers, how to select slot diffuser. For a smooth gaming experience, our experts only trust top software developers, how to secretly win at slot machines. This is because they only develop high-quality new slots games casinos for both download and instant play versions. In such a way, casinos attract new customers. For players, this means they get a free possibility to win some cash and easily get it to their accounts, how to scare an online casino. You also have access to the promotions and the banking options to get into the game, how to score 30 line slot machines hit it rich. You can also get in touch with the customer support staff there from the mobile lobby. As one of the best coupon sites, CouponAsion is a professional coupon site, which you can find millions of coupons from 300K+ online retailers, like Amazon, eBay, The Iconic, Birchbox, ASOS, etc, how to rent slot machines for fun tyler, texas. We are committed to help coustomers save more money and more time when they shopping at their favorite stores. Ignition is just a minimum of the poker and wager before a more, how to rent slot machines for fun tyler, texas. Beyond that will soon as experienced gamblers. Captivating Casino Tournaments & Slots Promotions. Join intriguing online casino tournaments and strive for the slots jackpot with online slots promotions, how to remove texas holdem poker buddy. Tactics that bring big wins instead of lame tiny wins, petit casino cagnes sur mer penetrante. Supermarche casino drive 59 route de france, cagnes-sur-mer, how to score 30 line slot machines hit it rich. Enjoy a selection of our great free slots on the go, how to score 30 line slot machines hit it rich. These types of free slots are great for Funsters who are out-and-about, and looking for a fun way to pass the time.

How to report gambling losses on tax return, how do i prove gambling losses on my taxes

Drawback #1: Lack of regulation. The hottest online sportsbooks are totally licensed and persist with KYC/AML regulations. This is as a end result of fiat currency circulates between events. The funds go through banks, monetary establishments, governments, how to report gambling losses on tax return. https://usedmercedesspares.co.za/community/profile/casinoen29500341/ You are allowed to list your annual gambling losses as an itemized deduction on schedule a of your tax return. If you lost as much as, or more than, you won. You can then report the $10,000 allowable wagering loss (equal to your. When wagering, there is the chance of incurring losses. For tax purposes, gambling losses are tax deductible if you itemize your deductions and. Before your numbers came up, there’s a way you can turn those losses to your tax advantage. The answer can make a big tax difference in the eyes of the irs. Amateur gamblers who don’t itemize can’t claim gambling loss deductions. Taxpayer-gamblers are not generally aware of the ease with which the irs successfully counters attempts to offset gambling winnings with. Withheld from gambling winnings; how to report winnings and document losses;. When the taxpayer in this case claimed her gambling losses as schedule c business losses on her federal income tax return and this claim was. Gambling losses and irs. Gambling losses irs audit. Tip: eadsy have a nonresident alien income, form w2-g, keno tickets, while miscellaneous expenses. You can deduct gambling losses only if you itemize deductions on your federal income tax return. Also, the amount of losses you. A sizeable percentage of these winnings may be recovered if you file a tax return asking the irs to take your gambling losses into account. You report gambling gains and losses in two separate places on the tax return. Report what you won as income on line 21 of the 1040

Today’s Results:

Frozen Diamonds – 446.5 eth

Family Guy – 681.1 bch

Aztec Secrets – 228.8 btc

Harvest Fest – 224.8 dog

Wildcat Canyon – 303.5 bch

Necromancer – 678.7 ltc

Girls with Guns Jungle Heat – 381.8 bch

Lucky Coin – 352.7 eth

Glorious Rome – 558.4 dog

Dragon Palace – 725.5 dog

Sherwood Forest Fortunes – 122.1 usdt

Space Battle – 359.5 ltc

Indiana’s Quest – 480.4 btc

Space Battle – 743.5 dog

Bingo Billions – 240.7 dog

New Games:

mBit Casino Bonanza

King Billy Casino Gaelic Warrior

1xSlots Casino Aeronauts

1xSlots Casino Piggy Bank

22Bet Casino Boomerang Bonanza

BitcoinCasino.us Charming Queens

Vegas Crest Casino Good Girl Bad Girl

Bitcoin Penguin Casino Red Baron

1xSlots Casino Drone Wars

Mars Casino Fruity Mania

Mars Casino Totem Island

OneHash Epic Gems

BetChain Casino High Society

Betcoin.ag Casino Best New York Food

Mars Casino Firemen