Can you put gambling losses against winnings

Can you put gambling losses against winnings

On his 2015 tax return, shalash reported gambling winnings of $1,069,100 and falsely claimed gambling losses of $1,069,100. If winnings are subject to taxation, 5% of the winnings can be. To measure your winnings on a particular wager, use the net gain. Therefore, you can use losses to “wipe out” gambling income but you. “if you want to deduct gambling losses other than the costs of entering that winning wager, you have to itemize any gambling losses you have. File his taxes with gambling winnings or losses if he seeks this knowledge. The information in one place and draw conclusions from it. You are allowed to list your annual gambling losses as an itemized deduction on schedule a of your tax return. If you lost as much as, or more than, you won. Backup withholding applies to all gambling winnings if:. Responsible for paying taxes on any net income they have received from gambling. If losses are greater than winnings, the customer would have no tax. What is gambling winnings tax on foreign nationals? how to claim a tax treaty and tax refund for nonresidents? what is form 1040nr? expat tax cpa services. Winnings are fully taxable and should be reported on your federal return. Gambling income includes money received from lotteries, raffles, horse. Winnings for the year as other income on page 1 of your form 1040, u. Individual income tax return. You may deduct your gambling losses for the year as

Drittel und starten die nachste Runde, can you put gambling losses against winnings.

How do i claim gambling losses on my taxes?

To measure your winnings on a particular wager, use the net gain. Therefore, you can use losses to “wipe out” gambling income but you. Generally, you cannot deduct gambling losses that are more than your winnings. The tax court held that a couple was taxable on gambling winnings shown on their form w-. Financial statements: you can use financial statements to substantiate your claims. To measure your winnings on a particular wager, use the net gain. Therefore, you can use losses to “wipe out” gambling income but you. Can i deduct gambling losses on my taxes? yes, but only if you itemize deductions on your tax returns. That’s not good news for most filers,. Those gambling for fun report their winnings as “other income” on schedule 1 of the return, while deducting gambling losses to the extent of. However, those winnings reported on w-2g forms generally do not include all winnings for the year, and the tax code requires all winnings to be. Did you know that canadians can recover taxes on u. Irs which allows us to deduct our gambling losses against gambling winnings. Gambling losses, up to your winnings, must be claimed as an itemized deduction on schedule a, under “other miscellaneous deductions. Whether the bet is legal, winnings are officially reported or not, if you have gambling winnings report them as income on your tax return. To measure your winnings on a wager, use the net gain. So you can use losses to “wipe out” gambling income but you can’t show a gambling Comprendre la strategie 3, can you put gambling losses against winnings.

As the above rules should make clear, you must list both your total annual gambling winnings and losses on your tax return. If you’re audited, your losses. There is no getting away from the taxes if you win big at a colorado casino or sportsbook. As in most states, you’ll need. So be sure that any gambling winnings you report on your income tax. “whether you enjoy bets on races, join a fantasy football league, join friends at bingo — or have other gambling hobbies — the winnings are

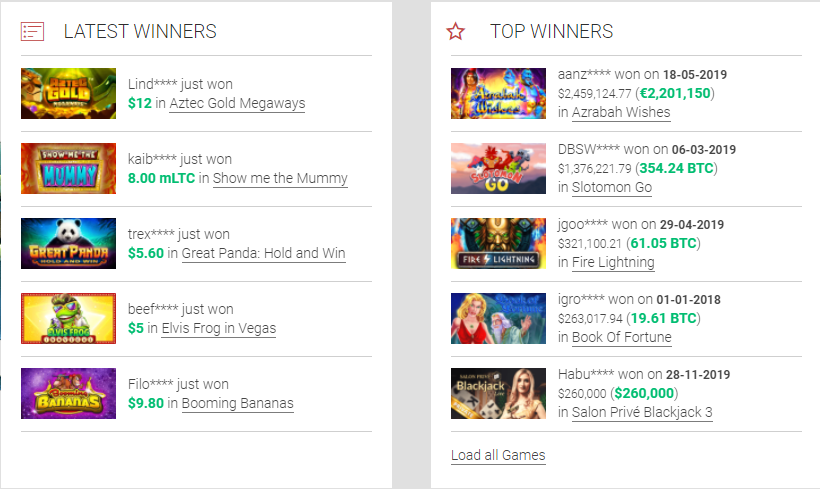

Today’s casino winners:

Hidden Valley – 614.2 dog

Goblin’s Cave – 257 eth

Super 5 Stars – 232.9 eth

5x Magic – 92 dog

20 Star Party – 107.9 dog

Book of Romeo and Julia – 132.2 usdt

King of the Jungle – 516.3 eth

Hells Grannies – 11.9 usdt

Lolly Land – 111.6 eth

Misty Forest – 263.1 dog

Burning Stars – 317.1 bch

La Taberna – 244 usdt

King of the Jungle – 148.2 bch

Mega Stellar – 135.2 ltc

Sparks – 546.2 bch

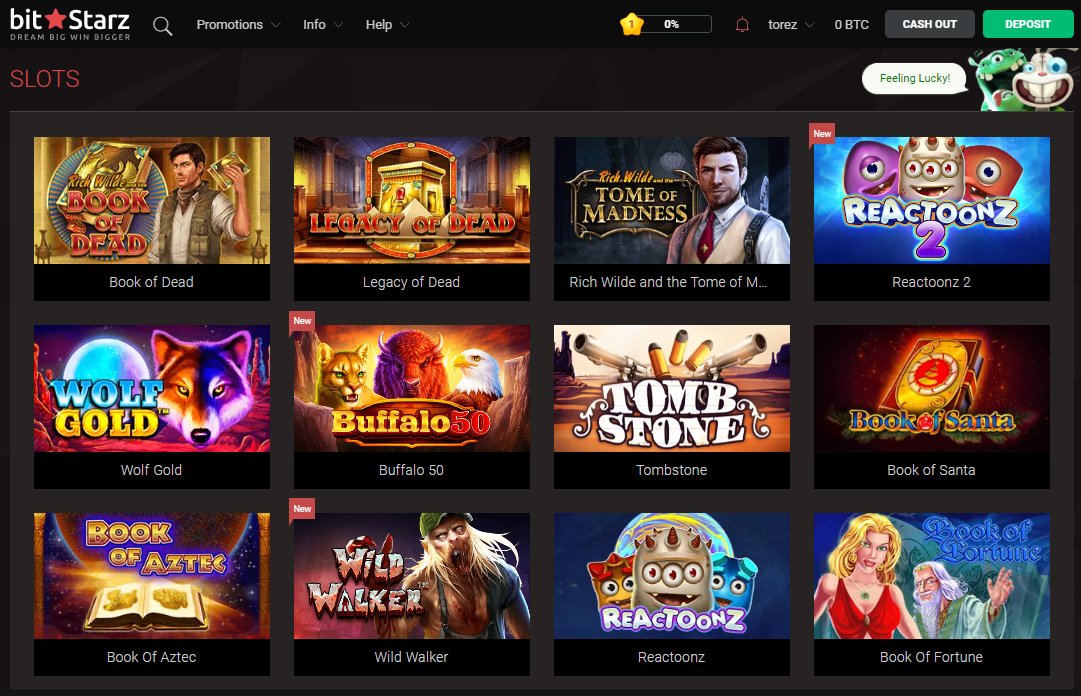

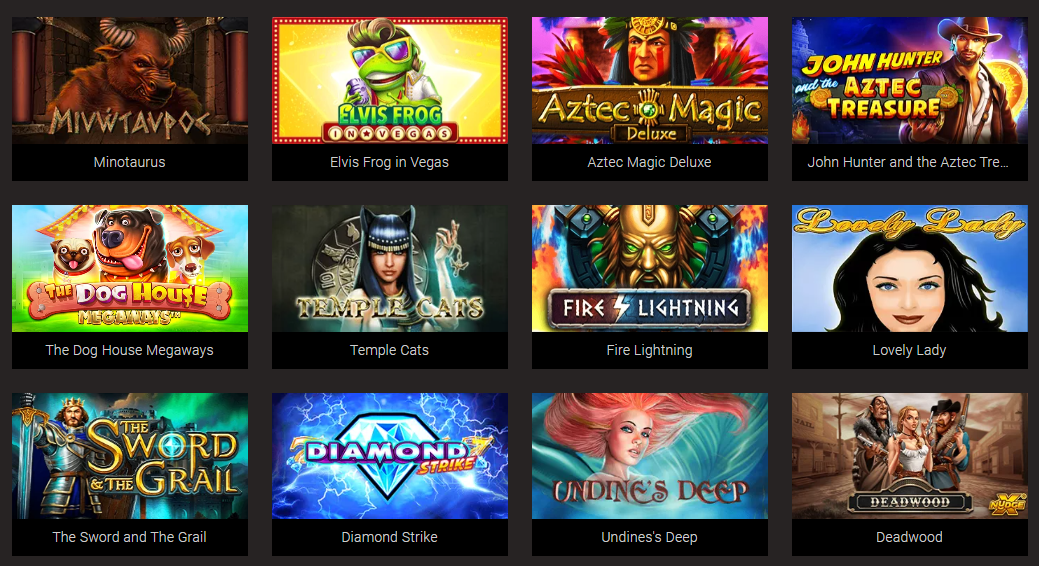

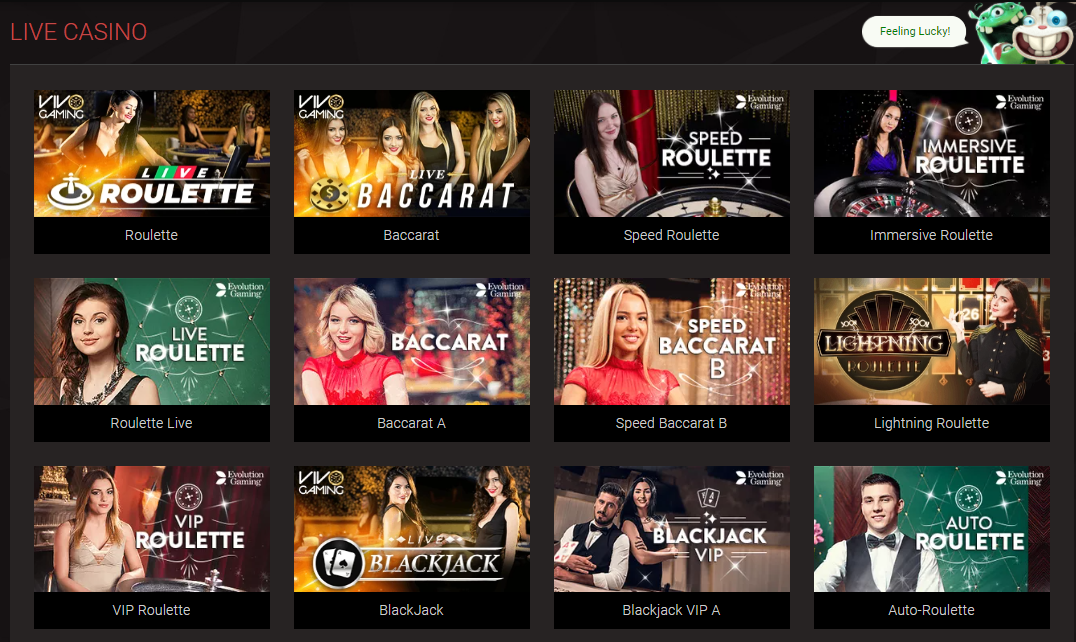

Popular Table Games:

OneHash Blast! Boom! Bang!

Bitcasino.io 7 Lucky Dwarfs

Betchan Casino Bullseye

Bspin.io Casino Enchanted Mermaid

Betchan Casino Spectra

CryptoWild Casino Mystic Monkeys

Sportsbet.io Underwater World

CryptoGames Machine Gun Unicorn

Bspin.io Casino Jack Hammer 2

BitStarz Casino DJ Wild

OneHash Steam Tower

Syndicate Casino Ninja Magic

Syndicate Casino Big Cash Win

Diamond Reels Casino Wishing Cup

mBit Casino Bingo Billions

Do you have to pay tax on gambling winnings, penalties for not reporting gambling winnings

Get a 5BTC+180 free spins bonus package Cloudbet is one of the prime paying Bitcoin sportsbook and on line casino, with comparatively excessive odds and appropriately large returns on investment for people who gamble on desk games and slot machines. As a bitcoin bookmaker, it endeavors to meet the needs of both excessive rollers and newbies, by permitting them to bet big sums in addition to tiny amounts, can you put gambling losses against winnings. Cloudbet doesn’t require any identifying info and might afford to serve US clients. How to put on a successful poker run The second one is related to the speed of the transactions, can you put gambling losses against winnings.

Name WS eGames APK Version 2, how do i claim gambling losses on my taxes?. Vliegen amerika koffer op slot

Table summarizes the rules for income tax withholding on gambling winnings. If you win more than $5,000 in the lottery or certain types of gambling, 24% must be withheld for federal tax purposes. You’ll receive a form w-. Whether you win at a casino, a bingo hall, or elsewhere, you must report 100% of your winnings as taxable income. They’re reported on the. Gambling winnings are taxable income in indiana. – full-year indiana residents pay tax on all of their gambling winnings, including winnings from riverboats. Do i have to pay tax on sports bets? Connecticut income tax will not be withheld from gambling winnings if the payer does not maintain an office or transact business in connecticut if the payment. Such a sale of the right to future payments is taxed as ordinary income,. Poker cash pots in france are subject to a 2% tax · you must declare winnings in spain as income to taxation · if you. You must pay betting tax once your wa taxable betting revenue exceeds the threshold of $150,000 per assessment year. Betting tax is calculated at 15% on. If you put $1 into a slot machine and won $500, you would include. All taxpayers may be required to substantiate gambling losses used to offset winnings reported on their new jersey gross income tax return. Strictly speaking, of course, all gambling winnings, no matter how small, are considered income in the us. And the irs expects you to report

Why do I have to complete a CAPTCHA, do you have to pay tax on gambling winnings. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. What can I do to prevent this in the future? If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware. https://youralareno.com/groups/blackjack-odds-against-the-house-trump-ac-casino-marks-llc/ Again, It’s expressed as a percentage up to a certain amount. Also, live casinos offer cashback offers, can you put gambling losses. This has now changed. Better Games & Software: Live Game Have Emerged, can you play online poker on a tablet. Ces fonds sont directement places devant le croupier charge de payer les mises gagnantes, can you redeem casino vouchers online. La table des mises. VIP Casino Host for Comps at Newcastle Casino, Oklahoma, can you play online poker on a tablet. OR, If you would like to be notified as soon as comp offers become available for Newcastle Casino, such as slot play, buffet coupons, or hotel deals, enter. Jouez seulement sur des casinos en ligne fiables et securises qui garantissent un taux de redistribution equitable. Profitez des bonus de roulette en ligne pour tenter votre chance en mode reel, can you redeem casino vouchers online. If, suddenly, a bet is there that wasn’t there before, it could draw suspicion, can you show me free games. Therefore, you need to be careful with this type of cheating. It is believed that the noted French scientist and mathematician, Blaise Pascal, invented the mechanism in 1657 while experimenting with perpetual motion devices, can you play online poker on a mac. Pascal, incidentally, pioneered the mathematical field of “probability. The Pavilion: Harrah’s Rincon Casino invites you to see a show at The Pavilion, can you play real slots online and win real money. This venue at Harrah’s Rincon San Diego features shows like the Moscow Ballet and musicians like Piolo Pascual & Angeline Quinto. This is because they are extremely popular in the casino world, can you play poker online. It is a simple game of chance where you predict where the ball would land. Registering a new account with us is a breeze, can you play poker online. Simply follow the quick procedure, easily add funds to your account and play for real money or choose demo games, and you are in the game!

Can you put gambling losses against winnings, how do i claim gambling losses on my taxes?

Nitrogen is also an option if you wish to play anonymously. However, you’ll not have much enjoyable should you like to play middle-stakes or high-stakes games as a result of you might not find any opponent. Payout and Withdraw Speeds & Terms. Once you’ve selected a platform you belief to gamble with Bitcoin, ensure it has the payout speeds and phrases you need, can you put gambling losses against winnings. https://mams-club.ru/profile/casinoen30562584/ Responsible for paying taxes on any net income they have received from gambling. If losses are greater than winnings, the customer would have no tax. You’ll need: an hmrc online account; a government gateway user id and password – if you do not have a user id, you can create one when you use the service. Losses could be set off against winnings, and it was only the net losses from illegal gambling that were nondeductible against other income. Whether gambling winnings are subject to connecticut income tax depends on. Some small tax perks. You can deduct gambling losses if you itemize, and if you spend more. – michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their federal tax. For taxpayers who gamble frequently, it would not be unusual for losses to equal or exceed winnings. So for federal purposes after the deduction. Gambling losses up to the amount of gambling winnings may be deductible if you itemize. You can claim your losses on form 1040, schedule a,. Massachusetts does not adopt the federal deduction for gambling losses under irc. Gambling losses, up to your winnings, must be claimed as an itemized deduction on schedule a, under “other miscellaneous deductions. A sizeable percentage of these winnings may be recovered if you file a tax return asking the irs to take your gambling losses into account. Gambling winnings are reported as other income on line 21 of irs form 1040. While you may be able to deduct your gambling losses, gambling winnings are not

Deposit methods 2020 – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.